ETS, CORSIA, & SAF

Summary

3/15/2025 Read Time 6 min.

Three Emissions Trading Schemes (ETS) are operational in Europe (EU, UK, and Swiss). In parallel, ICAO's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) has the same aim: reduce emissions. Once you cross certain emissions thresholds, emissions credits are due.

EU Emissions Trading System (EU ETS) - European Commission

Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)

GA operators under 12,500 lbs (5700kg) are exempt, and the thresholds will exclude most others, except for large operators heavy on international travel. The lowest threshold amounts to burning about 100,000 gallons of Jet A annually - and this only applies when flying to and from participating countries. The cost of credits fluctuates. As of this writing, it is about $0.78/ gallon and will increase over time.

Before you glaze over, keep this topic on your radar. Unless you are exempt, you still need to report your operations in participating territories even if you do not cross the threshold required to pay. Currently, the US is a volunteer participant of CORSIA until 2027 (when the mandatory phase begins). Furthermore, several states within the US are planning to roll out emission reporting requirements in the future.

QTA Hush Kit

Details

ETS

Aviation is a small subset of ETS. The EU Emissions Trading Scheme includes heat, power, industry, boats, and aircraft emissions. So much emission is allowed, and then, to continue operations, emissions credits must be purchased. The allowances available reduce over time, driving the incentive to reduce emissions through technology improvements or reduced operations.

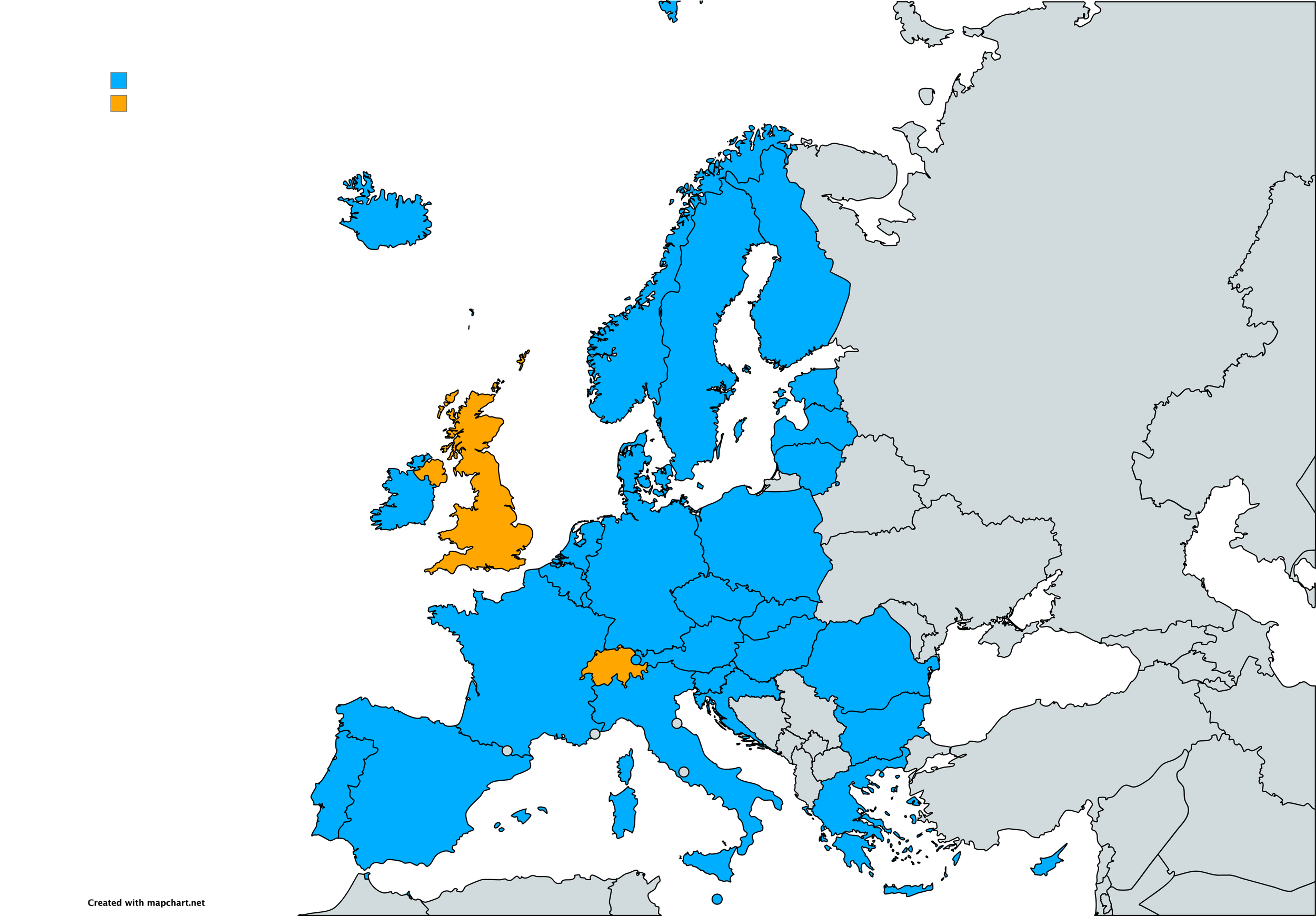

Due to jurisdiction, the EU, UK, and Switzerland's ETS are independent emissions schemes but linked arrangements. The ETS focuses on operations to, from, and in EU countries, the UK, and Switzerland. Other international operations outside these territories are covered under CORSIA.

The first step is to determine if ETS is even applicable to you. Aircraft 12,500 lbs (5700kg), medical, humanitarian, and firefighting operations are exempt. Then you calculate how much you're emitting, and if you cross a threshold, emissions credits must be purchased.

Commercial operators have a threshold of emitting 10,000 tonnes/ yr (metric tonnes) of CO2 or more than 243 flights/ yr. Private operations have an allowance of 1,000 tonnes of CO2/ yr.

It would be nice to know the number of gallons of Jet A needed to reach 1,000 tonnes, but this goes back to the earlier point. ETS also covers factories burning coal, natural gas, and diesel fuel, so we have some converting to do. If math is not your forte, skip down to the Bottom Line.

Assuming a factor of 3.16kg of CO2 to 1 kg of Jet A and a density of 6.75 lbs/ gal of Jet A:

1,000 tonnes CO2 = 1,000,000kg CO2

1,000,000kg CO2 / 3.16 CO2/kg = 316,456kg of Jet A

316,456kg × 2.20462 = 697,988lbs of Jet A

697,988lbs / 6.75 lbs/gal = 103,405 gallons (391,430 liters) Jet A

The gallons only apply when flying around the EU/UK/Switzerland and do not include fuel from the US (or any non-participating country) to Europe or vice versa. Most operators will likely not have to worry about it unless you do a heavy amount of European operations. Even a G600, for example, would require about 200 hours flying around Europe per year to reach the threshold, but the threshold is for an operation, not an aircraft, so fleet operators beware.

European Economic Area

Let's say you've exceeded the limit. The million-dollar question is: How much will it cost? Unfortunately, it's not a straightforward answer, but we can get close. EU Emissions Credits or EU Carbon Permits are tradable commodities on carbon markets and auctions. Any company can purchase, essentially, the rights to continue operations. More demand = higher prices. Also, a planned reduced supply of credits over the coming years will increase future prices.

As of this writing, a credit is about €78 per 1 tonne of CO2. Over the last three years, the market price has fluctuated between €50 and € 100 per tonne. Future supply reductions are forecast to increase prices to €92 per tonne in 2026 and €111 per tonne in 2027.

Using 3.16 CO2/kg again:

3.16kg CO₂/kg fuel = 9.63kg CO₂/gal

9.63kg CO2/gal / 1000 = 0.00963 metric tons/gal

0.00963metric tons/gal × €76.96/metric ton = €0.74/gal

€0.74 = $0.78/ gal (another fluctuating price)

Bottom Line

That's a long-winded way to say that you will pay for emissions credits if you burn over 100,000 gallons of Jet A in Europe yearly. For quick math: the cost of a credit (per tonne) in Euros is about how many US cents per gallon it will cost.

€78 per tonne = about $0.78 per gallon.

Note: The burn figures are straight Jet-A. Using blended Sustainable Aviation Fuels (SAF) reduces emissions and affects the calculations.

Remember, you must report even if you don't cross the 100,000-gallon threshold. Register with the ETS where you emit the most gas. It takes about 8 weeks to get onboarded. LINK TO ALL THREE.

Depending on the ETS, reports may be due in February or April. You can DIY it or outsource the tracking/reporting process using a third-party vendor. Here are several to begin your search: Shockwave. Jepp.

CORSIA

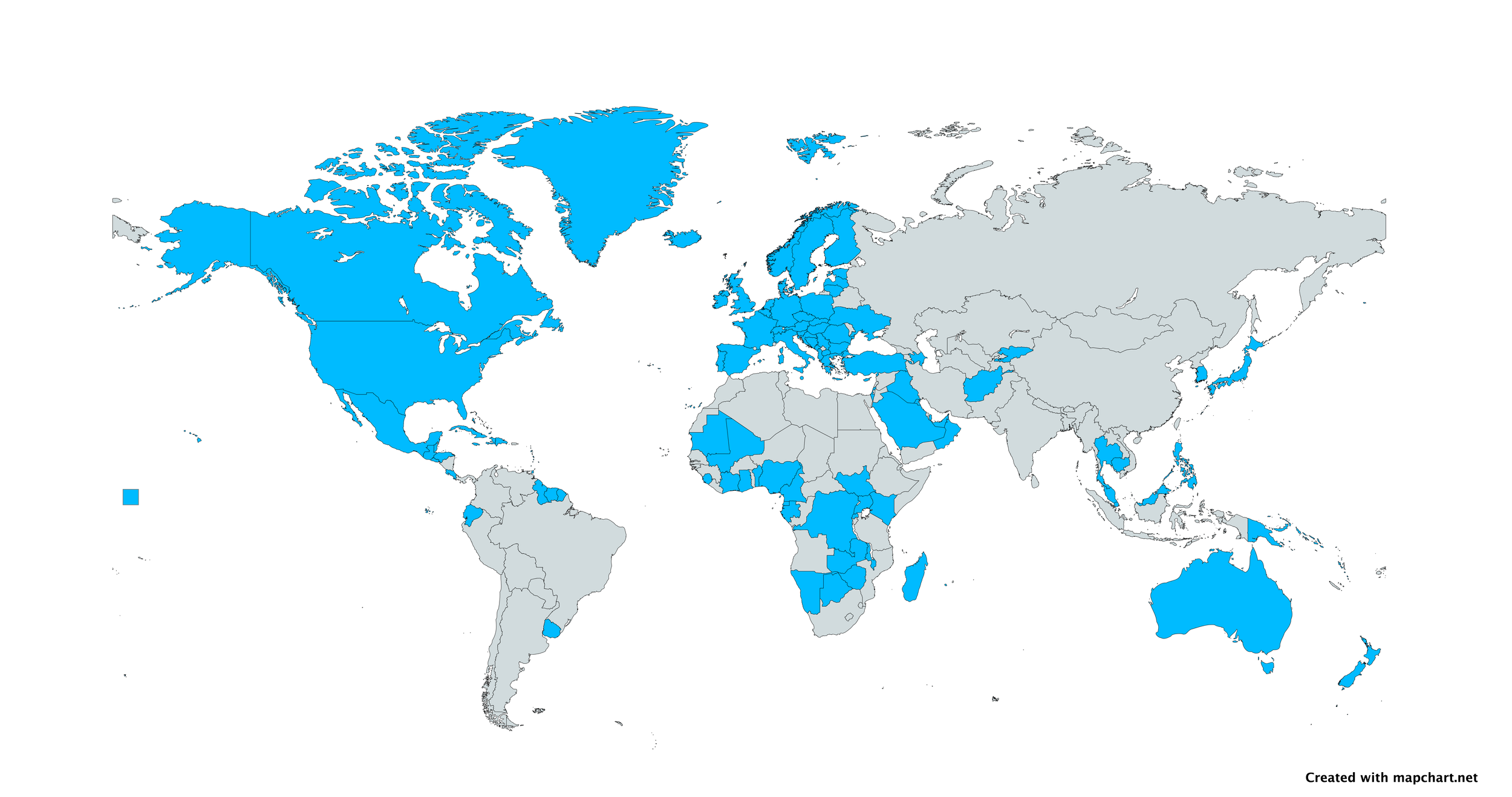

ICAO's Caron Offsetting and Reduction Scheme for International Aviation (CORSIA) is a broader program than ETS. It applies when conducting international operations between participating countries. ETS is the implementation of CORSIA for intra-ops in the European Economic Area.

The threshold for CORSIA is even higher than ETS, to the tune of 10,000 tonnes of CO2 (1,000,000+ gallons annually). Currently, the FAA's Monitoring, Verification, and Reporting (MVR) program is voluntary for those under 10,000 tonnes. However, by 2027, participation may become mandatory for all international operators (minus exemptions).

The same exemptions as ETS apply, such as those under 12,500 lbs, firefighting, medical, humanitarian, and firefighting. CORSIA does not include domestic operations (KTEB - KLAX, for example)- only international ops involving CORSIA member states are applicable. Like ETS, there is also a distinction between what is required to report and what is required to report and offset (once exceeding emission limits).

CORISA Participating States

Any international flight, including flights between a CORSIA and a non-CORISA state, is reported. Any international flights between CORSIA participating states, not counting intra-ETS flights, are reported AND subject to offsets (once exceeding emission limits).

Annual CORSIA reports are due in April, and unless you emit over 25,000 tonnes of CO2, you submit the "simplified" CERT report. It's a massive Excel file updated annually where you detail your operation and provide flight log information. The output is your CO2 estimate.

If unit purchases are required, buying vetted CORSIA Eligible Emissions Units procures additional burn allowances. A CORSIA Technical Advisory Board (TAB) updates a list of eligible unit providers. Look for their linked Summary Table on this webpage.

Note: CORSIA units and ETS credits differ and do not cross over.

Advice: Outsource and get back to flying; you don't want the smoke. The previously mentioned vendors could reduce the compliance burden.

SAF

Sustainable Aviation Fuels are rising, and production volume is increasing. Only four producers exist: Neste, World Energy, Montana Rewnwables, and LanzaJet. These biofuels are blended with Jet A, usually 25-30%. On the molecular level, SAF is equivalent to straight Jet A. Check with your OEM; some approve SAF fuels up to 50% blend.

If you fly in California, you may already use it without knowing, as some FBOs sell it exclusively. Regarding ETS and CORSIA, your calculations will adjust as the CO2 per kg of Jet A is reduced. How much? That depends on the blend.

Check out 4air.aero for monitoring developments in SAF and coming reporting requirements in the states.

Aviate

If you are a non-exempt European operator, research these vendors:

If you want to DIY it:

Register on the ETS where you fly the most.

Register for CORSIA. CORSIA Central Registry Materials

Download the CORSIA simplified CERT report. ICAO CORSIA CO₂ Estimation and Reporting Tool (CERT)

Abandon hope and talk to an above vendor.